will capital gains tax rate increase in 2021

Unlike the long-term capital gains tax rate there is no 0. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

The proposed increase would tax long-term gains over 1 million as ordinary income which means that these high-income investors would have to pay a top rate of 396.

. The number marks an 8 increase from August and outpaced the more than the 5 month-over-month growth of all wholesale. First deduct the Capital Gains tax-free allowance from your taxable gain. Imposes a progressive income tax where rates increase with income.

Hundred dollar bills with the words Tax Hikes getty. The Federal Income Tax. 2021 Longer-Term Capital Gains Tax Rate Income Thresholds.

For long-term capital gains thats a potential increase of up to 196 over the current. That threshold will rise about 7 to 44625 in. The Chancellor will announce the next Budget on 3 March 2021.

The Chancellor will announce the next. BDO Global 2021 Financial Results. Capital Gains Tax Rate.

Implications for business owners. Capital Gains Tax. That rate hike amounts to a staggering 82.

House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. However it was struck down in March 2022. For instance in 2022 single taxpayers who earn below 41675 arent required to pay capital gains taxes on their investments.

Here are 10 things to know. Solid Growth Takes Worldwide Revenues over 11 Billion. The proposal would increase the maximum stated capital gain rate from 20 to 25.

Its time to increase taxes on capital gains. Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. Note that short-term capital gains taxes are even higher.

Special cases for taxation. The 238 rate may go to 434 for some. The catch is that this is offset by other income.

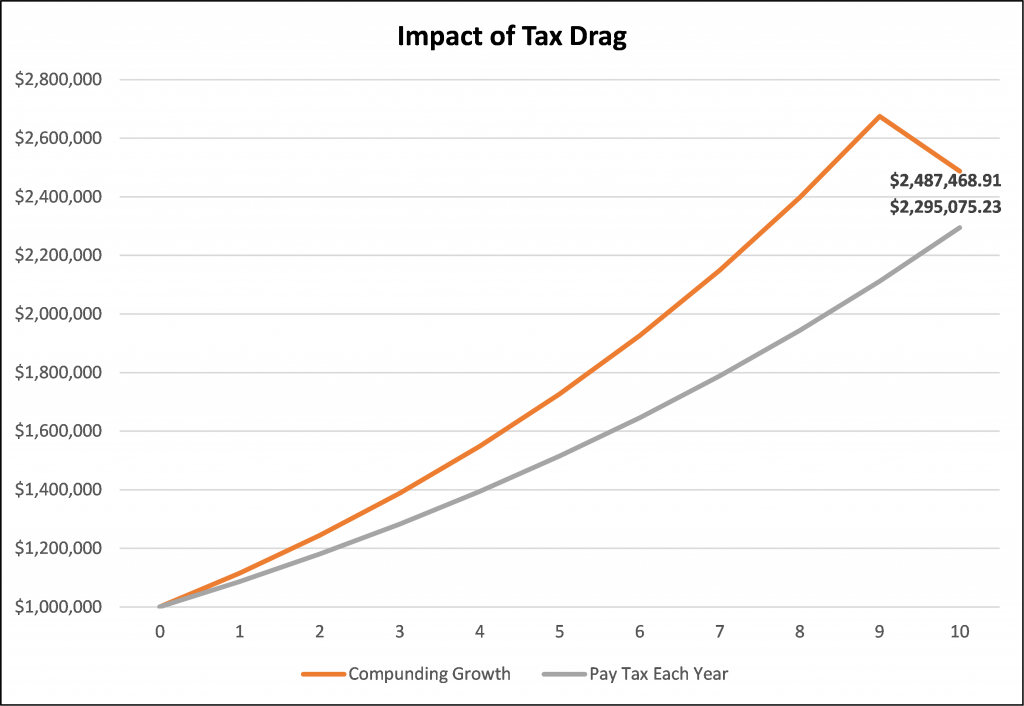

Sell assets in a low tax year Under current tax law the first 80000 of long-term capital gains can be taxed at a 0 rate. The effective date for this increase would be September 13 2021. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Tax Changes and Key Amounts for the 2022 Tax Year. The proposal would increase the maximum stated capital gain rate from 20 to 25. Many speculate that he will increase the rates of capital.

Add this to your taxable. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is.

2021 Capital Gains Tax Rates Brackets Long-Term Capital Gains. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

There are seven federal income tax rates in 2023. With average state taxes and a 38 federal surtax. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains tax as high. Long-term capital gains taxes are assessed if.

Weve got all the 2021 and 2022 capital gains. Capital gains also may be subject to the 38 Net Investment Income Tax. Many speculate that he will increase the rates of capital.

A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase. Short-Term Capital Gains Tax Rates for 2021. Yes ZERO percent tax.

Capital Gains Rate 20 25 Or 40 Should We Care Round Table Wealth

The Tax Impact Of The Long Term Capital Gains Bump Zone

What Are Capital Gains Taxes And How Could They Be Reformed

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Capital Gains Tax In The United States Wikipedia

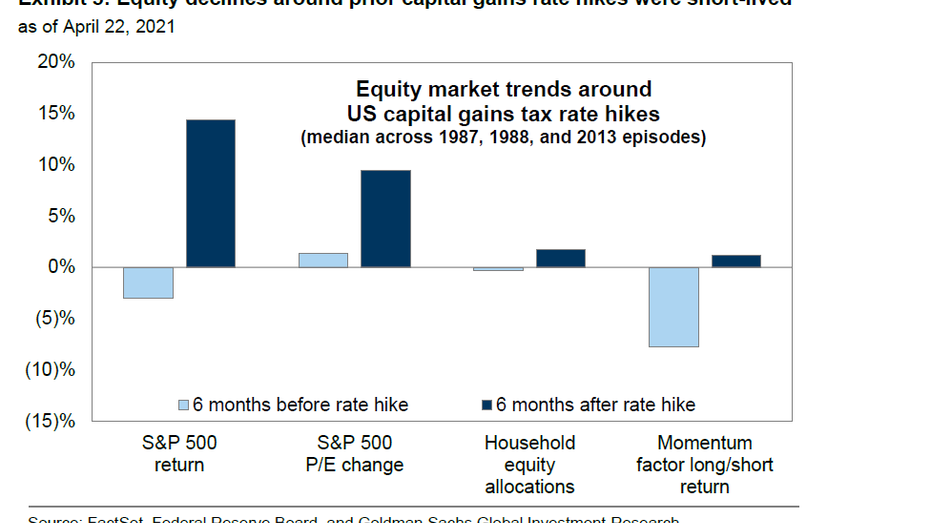

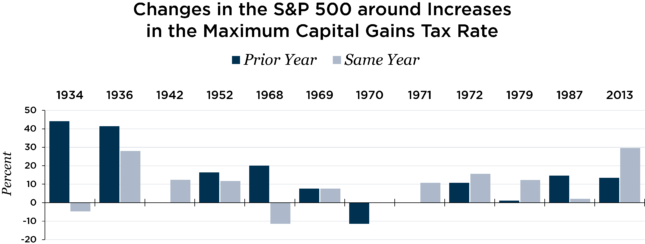

Capital Gains Tax Hikes And Stock Market Performance Fox Business

Stocks Retreat On Capital Gains Plan Nationwide Financial

State Taxes On Capital Gains Center On Budget And Policy Priorities

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Mechanics Of The 0 Long Term Capital Gains Rate

2 Quick Points To Simplify Capital Gains Tax By Tunji Onigbanjo Datadriveninvestor

Managing Tax Rate Uncertainty Russell Investments

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Capital Gains Tax Hike And More May Come Just After Labor Day